Annuity Income, Insurance Loans & IRAs: Mixing Strategies for a Smoother, Tax-Friendly Retirement

- Marty Blackmon

- Jul 28, 2025

- 5 min read

The Tax Challenge in Retirement

When it comes to retirement planning, most people focus on accumulating enough assets. But what happens when you finally reach retirement? Overlooked and underestimated in its power to influence your quality of financial life in retirement, is the way you withdraw your money and spend down your assets. This action will ultimately be more important than how you saved it and potentially more important than how much you saved.

One of the biggest challenges retiree's faces is managing their tax brackets. Without careful planning, you might find yourself paying significantly more in taxes than necessary, effectively reducing your retirement income and potentially depleting your savings faster than anticipated.

This is where strategic planning comes in. By mixing different income sources with varying tax treatments, you can create a more tax-efficient retirement strategy that preserves your wealth and maximizes your income.

Understanding Tax Brackets in Retirement

Before diving into strategies, it's important to understand how retirement income is taxed. In retirement, your income can come from various sources, each with different tax implications:

- Social Security: Up to 85% may be taxable, depending on your combined income

- Traditional IRA/401(k) withdrawals: Fully taxable as ordinary income

- Roth IRA/401(k) withdrawals: Tax-free (if qualified)

- Pension payments: Generally fully taxable

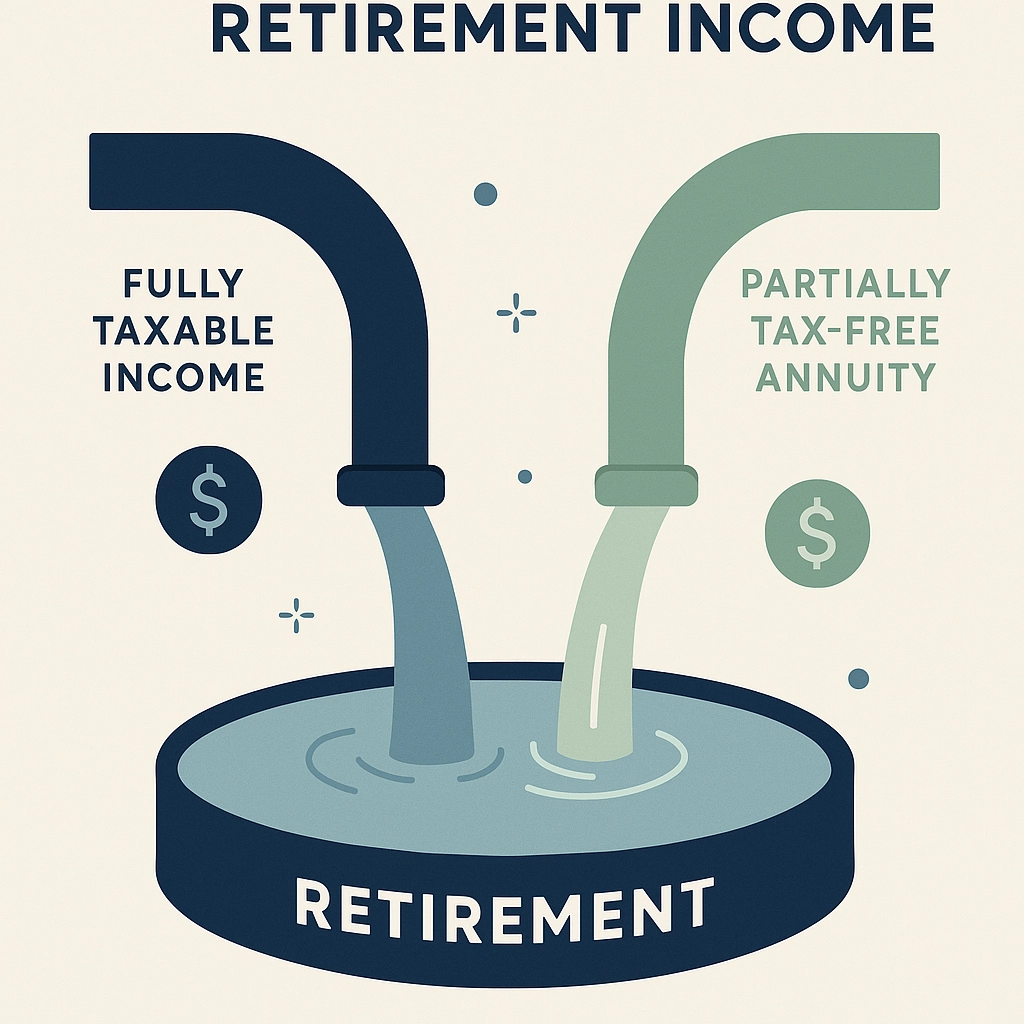

Annuity payments: Partially taxable, depending on the type, qualified vs non-qualified.

- Life insurance policy loans: Not considered taxable income

By strategically drawing from these different buckets, you can control which tax bracket you fall into each year. This approach, often called "tax bracket management," can potentially save you thousands in taxes throughout retirement.

The Power of Whole Life Insurance Loans

One of the most underutilized tools for tax-efficient retirement planning is the strategic use of whole life insurance policy loans.

Here's how it works: When you purchase a whole life insurance policy, part of your premium goes toward building cash value. Over time, this cash value grows tax-deferred within the policy. Once you've accumulated sufficient cash value, you can borrow against it.

The key tax advantage? Policy loans are not considered taxable income by the 7702 Section of the IRS tax code. This means you can access cash without triggering additional income tax or pushing yourself into a higher tax bracket.

For example, if you're approaching the upper limit of your current tax bracket, instead of withdrawing more from your IRA (which would be taxed as ordinary income), you could take a policy loan to meet additional cash needs without increasing your taxable income.

Some important considerations with insurance policy loans:

- They must be properly structured to avoid becoming modified endowment contracts (MECs)

- Interest accrues on the loan balance

- Unpaid loans reduce the death benefit

- The policy must remain in force for the tax advantages to apply

Income Annuities: Tax-Efficient Guaranteed Income

Income annuities provide another powerful tool for creating tax-efficient retirement income. These financial products convert a lump sum into a stream of guaranteed income that can last for a specific period or for life.

What makes annuities particularly valuable from a tax perspective is how the payments are treated:

- A portion of each payment is considered a return of your principal (non-taxable)

- Only the earnings portion is subject to taxation

- This creates a lower effective tax rate on your income stream

For example, if you purchase an immediate annuity with $300,000 at age 65, a significant portion of each monthly payment might be tax-free return of principal, while only a smaller portion would be taxable as ordinary income.

The Annuity Tax Advantage

Income annuities offer a unique tax advantage through what's called the "exclusion ratio." This ratio determines what percentage of each payment is considered return of principal (tax-free) versus taxable income.

For example, if your exclusion ratio is 70%, then 70% of each payment you receive is tax-free. This significantly reduces the tax impact of your retirement income.

What makes annuities even more powerful is the lifetime income rider option. These riders ensure you'll receive income for life, even if you outlive the account value of your annuity. The growth in the annuity that funds these lifetime payments is shielded from capital gains taxes, making it an efficient way to secure guaranteed lifetime income.

Strategic Use of Traditional and Roth IRAs

IRAs play a crucial role in any tax-efficient retirement strategy:

Traditional IRAs provide tax-deferred growth, meaning you don't pay taxes on the earnings until withdrawal. Contributions may be tax-deductible, reducing your current tax burden. However, withdrawals in retirement are taxed as ordinary income.

Roth IRAs offer tax-free growth and tax-free qualified withdrawals. While contributions are made with after-tax dollars, the long-term tax benefits can be substantial, especially if you expect to be in a higher tax bracket in retirement.

The strategic use of both types creates tax diversification, giving you flexibility to manage your tax brackets each year in retirement.

Bringing It All Together: The Integrated Strategy

The most effective approach combines all three elements—whole life insurance, income annuities, and IRAs—into a comprehensive strategy that maximizes tax efficiency while ensuring reliable income throughout retirement.

Here's how this integrated approach might work:

Establish your baseline income needs using Social Security and perhaps a portion of your retirement accounts

Add a layer of guaranteed income with an income annuity to cover essential expenses, benefiting from the exclusion ratio that makes part of each payment tax-free

Utilize Roth accounts strategically for additional income needs that would otherwise push you into a higher tax bracket

Leverage whole life insurance policy loans when you need additional funds without increasing your taxable income

Tap traditional IRAs and 401(k)s to fill remaining income needs, being careful to stay within your target tax bracket

Case Study: The Mixed Strategy in Action

Let's consider a hypothetical couple, Tom and Sarah, both age 65, who have accumulated the following assets:

- $800,000 in traditional IRAs

- $200,000 in Roth IRAs

- $300,000 in a whole life insurance policy (with $150,000 cash value)

- $40,000 annual Social Security benefits (combined)

Their annual expenses are $85,000. Without a strategic approach, they might simply withdraw $45,000 from their traditional IRAs each year to supplement their Social Security. However, this approach would create $85,000 in taxable income (including their Social Security benefits).

Instead, they implement a mixed strategy:

- $40,000 from Social Security

- $15,000 from a single premium immediate annuity purchased with $225,000 from their traditional IRA (with approximately 60% of each payment being tax-free return of principal)

- $10,000 from Roth IRA withdrawals (tax-free)

- $20,000 from a whole life insurance policy loan (not taxable income)

The result? Their taxable income is significantly reduced to approximately $46,000 (Social Security plus the taxable portion of annuity payments), potentially placing them in a lower tax bracket and saving thousands in taxes annually.

Important Considerations

While this mixed strategy approach offers significant tax advantages, there are important factors to consider:

For whole life insurance:

- Policies must be properly structured and funded

- Interest accrues on policy loans

- The policy must remain in force to maintain tax advantages

For income annuities:

- Once purchased, funds are generally no longer liquid

- Inflation can erode purchasing power unless inflation protection is added

- Provider financial strength is crucial

For IRA strategies:

- Required Minimum Distributions (RMDs) must be taken from traditional IRAs starting at age 73

- Roth conversion strategies should be considered during lower income years

- Estate planning implications differ between account types

Conclusion: Personalized Planning is Key

While the strategies outlined in this article can significantly enhance your retirement tax efficiency, the optimal mix depends on your specific situation, goals, and existing financial resources. Working with a financial advisor who specializes in retirement income planning can help you develop a personalized strategy that maximizes your after-tax income while ensuring your money lasts as long as you do.

At BlackFin Wealth Group, we specialize in helping our clients create integrated retirement income strategies that balance tax efficiency, guaranteed income, and growth potential. To learn more about how these strategies might apply to your situation, visit our retirement planning page or contact us for a personalized consultation.

Remember, it's not just about how much you've saved—it's about how efficiently you can turn those savings into lasting retirement income.

Comments