Liquidity Banking using Cash: Secrets Revealed: What Financial Advisors Don't Want You to Know or don't know themselves.

- Nov 8, 2025

- 5 min read

A lot of financial advisors like world renowned Suzi Orman and Dave Ramsey will tell you to "buy term insurance and invest the difference." They'll push you toward 401(k)s, IRAs, and market-based investments while steering you away from permanent life insurance. But here's what they're not telling you: Banks themselves hold over $130 billion in cash value life insurance while directing their retail clients toward volatile market investments.

Why the disconnect? Because there's a wealth-building strategy that combines the best of both worlds: liquid cash banking paired with strategic stock market investing: that can significantly outperform either approach alone.

What Is Liquid Cash Banking (And Why Banks Love It for Themselves)?

Liquidity Banking or Bank on yourself also known by various other names was developed by Nelson Nash in his groundbreaking book "Becoming Your Own Banker". The concept does not solely depend on a life insurance product but with Nelson, the way he taught it involves using overfunded whole life insurance policies as your personal banking system. Instead of storing money in traditional savings accounts earning minimal interest, you funnel cash into specially designed life insurance policies that build guaranteed cash value.

Here's the kicker: when you need money, instead of selling investments or taking taxable distributions, you borrow against your policy's cash value. The borrowed funds can be used for anything: investments, business opportunities, real estate: while your original cash value continues growing uninterrupted through compound interest.

Banks figured this out decades ago. While they're telling you to chase market returns, they're quietly using this exact strategy to build their own wealth with guaranteed, tax-advantaged growth.

The Power Play: Liquid Cash Banking + Stock Market Investing

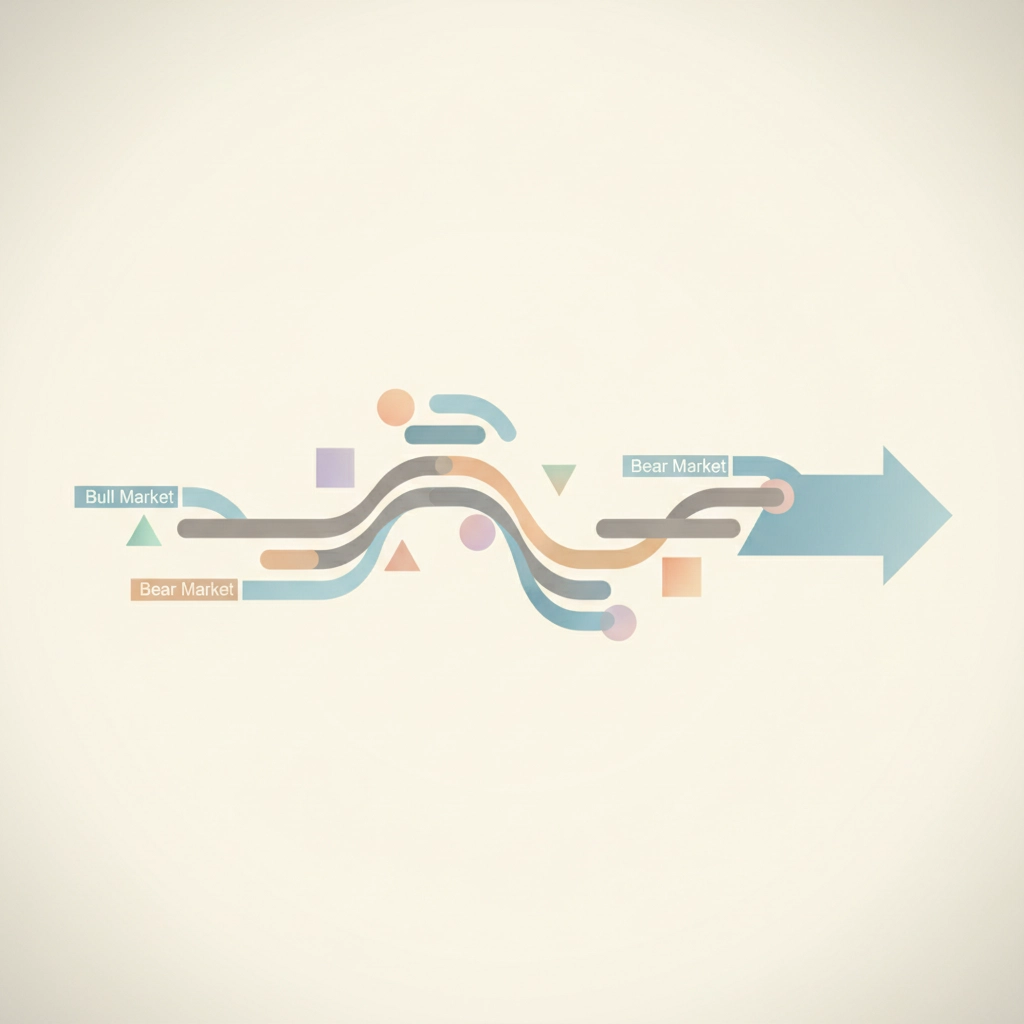

The real magic happens when you combine liquid cash banking with strategic market investing. Instead of choosing between guaranteed growth or market upside, you get both through a coordinated approach that reduces risk while maximizing returns.

Let's look at how this works through real-world case studies.

Case Study #1: The Strategic Retiree

Meet Sarah, a 45-year-old executive who started implementing this dual strategy in 2010. She allocated 40% of her wealth-building dollars to overfunded whole life policies and 60% to diversified stock investments.

The Setup:

$50,000 annually into whole life policies (building to $400,000 cash value by retirement)

$75,000 annually into stock investments (growing to $1.2 million by retirement)

The Retirement Strategy: When Sarah retired in 2020, instead of pulling from one source, she implemented a tactical withdrawal strategy:

Bull market years (2021, 2024): Withdrew from stock portfolio while it was up 15-20%

Bear market years (2022): Used policy loans when stocks were down 18%

Sideways years: Mixed withdrawals based on opportunities

Results: By using non-correlated assets strategically, Sarah's portfolio lasted 28% longer than traditional 4% withdrawal strategies, with significantly less sequence-of-returns risk.

Case Study #2: The Business Owner's Advantage

Tom, a business owner, took a different approach. He used infinite banking as his "opportunity fund" while keeping long-term investments in the market.

The Strategy:

Built $800,000 in policy cash value over 15 years

Maintained $1.5 million in diversified stock investments

Used policy loans for time-sensitive business opportunities and market downturns

The 2020 Opportunity: When markets crashed in March 2020, Tom borrowed $200,000 from his policies (tax-free) and invested it in quality stocks at 40% discounts. His original cash value continued growing at 4-6% guaranteed, while his opportunistic investments returned 180% over the following two years.

Total return enhancement: 23% higher than keeping money in traditional savings for opportunities.

Why This Combination Beats Either Strategy Alone

The Math Behind Non-Correlated Assets

When you combine guaranteed growth (whole life) with market-based investments, you create a portfolio with significantly reduced volatility while maintaining upside potential. Here's why:

Traditional Portfolio Issues:

100% market exposure = high sequence-of-returns risk

Bad timing in early retirement can devastate long-term outcomes

Forced to sell during market downturns

Combined Strategy Benefits:

Guaranteed cash value provides stability and income during market stress

Ability to buy opportunities when markets are depressed

No forced selling during downturns

Tax-free policy loans vs. taxable investment withdrawals

The Withdrawal Sequence Advantage

Research shows that withdrawal timing dramatically impacts portfolio longevity. Traditional retirees face a critical problem: they must sell investments regardless of market conditions to fund living expenses.

Liquid Cash banking + investing combination solves this through tactical withdrawals:

Year 1-3 (Bull Market): Harvest gains from stock portfolio Year 4-5 (Bear Market): Use tax-free policy loans, let stocks recover Year 6-10 (Recovery): Resume stock withdrawals, repay some policy loans

This approach can extend portfolio life by 8-12 years compared to traditional withdrawal strategies.

Breaking Down The Numbers: A 30-Year Comparison

Let's examine three approaches over 30 years with $100,000 annual contributions:

Option 1: All Stock Market

Total contributions: $3 million

Projected value (7% average): $9.4 million

Risk: High volatility, sequence-of-returns risk

Option 2: All Liquid Cash Banking via Insurance

Total contributions: $3 million

Projected value (5% average): $6.6 million

Risk: Very low, guaranteed growth

Option 3: Combined Strategy (50/50)

Stock portion: $4.7 million

Policy cash value: $3.3 million

Total: $8.0 million

Plus: Reduced risk, tactical flexibility, tax advantages

While the combined approach doesn't achieve the highest theoretical returns, it provides 85% of the upside with dramatically reduced risk and significantly more flexibility.

The Tax Advantage Nobody Talks About

Here's where the strategy gets even more powerful. Policy loans are not taxable events. When you need income in retirement, you're not triggering tax consequences like you would with 401(k) or IRA withdrawals. If you own a business, the tax breaks get even bigger but that's a topic for another day.

Traditional Retirement Income:

$100,000 withdrawal = $100,000 taxable income

Could push you into higher tax brackets

Affects Social Security taxation

Policy Loan Strategy:

$100,000 policy loan = $0 taxable income

Maintains lower tax bracket status

Preserves Social Security benefits

Allows Roth conversion opportunities in low-income years

Implementation: Getting Started

The key to success is proper policy design and strategic coordination. Not all life insurance policies work for liquid cash banking: you need policies specifically designed for cash accumulation with minimal insurance costs.

Essential Elements:

The most important thing you need to get started is someone or a team that understands how to design these policies like the team at BlackFin Wealth.

Work with Mutual Insurance carriers experienced in large cash banking design (like Penn Mutual)

Include over loan protection riders

Add chronic illness/long-term care riders

Coordinate with existing investment strategies (Very Important for tax strategy, not all insurance writers understand the planning part of finances)

Common Mistakes to Avoid:

Never repaying policy loans

Borrowing too aggressively early on

Choosing policies not designed for cash accumulation

Failing to coordinate with overall financial strategy

The Bottom Line: Why Advisors Don't Share This

Most financial advisors earn higher commissions from mutual funds, stocks, and traditional investment products and or charge annual asseta under management fees that can impact a portfolio over a lifetime dramatically. Whole life insurance pays much lower ongoing fees, making it less attractive from a compensation standpoint.

Additionally, liquid cash banking requires more sophisticated planning and coordination: it's easier to simply recommend "buy and hold" index funds than to design and manage a coordinated strategy using multiple asset classes.

But for families serious about wealth building, tax efficiency, and financial security, the combination of early cash banking with strategic market investing offers compelling advantages that traditional approaches simply cannot match.

The strategy isn't for everyone: it requires discipline, proper design, and long-term thinking. But for those willing to implement it correctly, it provides a level of financial control and opportunity that traditional retirement planning simply cannot deliver.

Ready to explore how early cash banking might fit into your wealth-building strategy? Contact our team to discuss your specific situation and learn more about our approach to coordinated wealth planning.

Comments